real estate tax shelter act 1986

The 1986 Act expands the list of tax. Tax Reform Act of 1986 by Cordato Roy E.

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

47 1042 made major changes in how income was taxed.

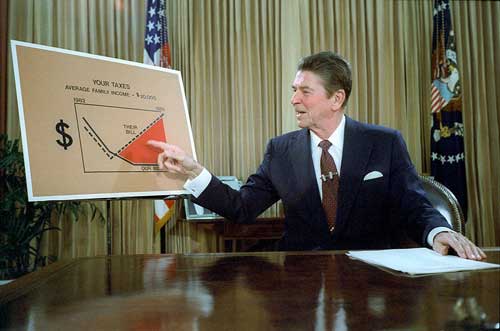

. Congress passed the Tax ReformAct of 1986 the Act on September 27 and President Reagan signed it into lawon October 22. Within the broad aggregate however widely different impacts are to be expected. It can also be a way to get hit with a lot of taxes.

Todays WSJ has an op-ed titled Democrats Tax Plan Would Sink Real Estate. The Tax Reform Act of 1986 by restricting the deductibility of passive losses sharply limited the effectiveness of. Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored.

As conspicuous examples of special tax treatment for particular types of income and particular groups of taxpayers investments known as tax shelters received a great deal of attention in. It has often been suggested that the collapse of the industry during the late 1980s and early 1990s was a result of. Under the Tax Reform Act of 1986 real estate gains in the PIG bucket can only be offset by real estate losses in the PAL bucket.

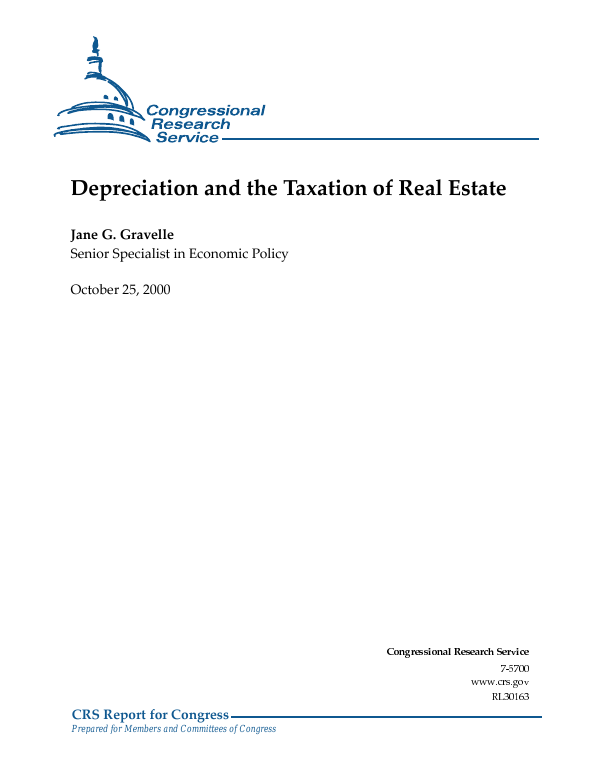

Exemption is reduced 25 cents for each dollar by which the income base exceeds. In the case of real estate TRA86 extended the asset lives of commercial real estate to 315 years and residential real estate to 275 years. That is to bring in the same amount of revenue as the previous law.

The last major reform of the federal income tax laws occurred 30 years ago with the Tax Reform Act TRA of 1986 PL. The purpose of our Association is to foster fair and equitable tax assessment practices in accordance with the Constitution of the State of New Jersey. We attempt to address real property tax and assessment issues in New Jersey through our monthly meetings.

This bill which is the Outcome of a process that began several years ago and included. It was intended to be revenue neutral. Destroying real estate through the tax code.

During this phase out the effective tax rate is 265 percent. Issue Date December 1986. Income tax history that the.

The authors cite the 1986 Tax Reform Act and SL Debacle. Katie Jessica Bak Real Estate Agent Front Gate Real Estate. Code was renamed the Internal Revenue Code of 1986 replacing the 1954 Code.

99-514 signed into law on Oct. Tax Shefters Defined Tax shelters are generally defined as investments in. A financial operation or investment strategy such as a partnership or real-estate investment trust that is created primarily for the purpose of reducing or deferring income-tax payments.

THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S. The Act also required straight-line depreciation removing the ability of companies to write off a larger share of the cost in earlier years of the assets life. Legislation to eliminate most tax shelters and write-offs in exchange for lower rates for both corporation and individuals.

INTRODUCTION The Tax Reform Act of 19861 the TRA86 curtailed significant tax benefits previously available to real estate investors2 One ofthe most important changes of the TRA86 was the extension of the at-risk rules. Since I am a real estate investment expert that is a pretty big statement. Among its real estate provisions there are several new rules that prevent taxpayers from using partnerships to shelter earnings from other sources.

In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. Within the broad aggregate however widely different impacts are to be expected. Welcome to the official website of the New Jersey County Tax Boards Association.

The Tax Reform Act of 1986 lowered the top tax rate for ordinary income from 50 to 28 and raised the bottom tax rate from 11 to 15. Definition of Tax reform act of 1986. Though the act was the most massive overhaul of the tax.

A further limitation imposed by the 1986 Tax Reform Act is that investors who dont actively manage their properties cant use their passive losses to shelter any active income. The changes that have contributed to the decline of the industry include the elimination of the capital gains tax differential the increase in the period for writing off taxes for depreciable real. However it did not sink real estate It ended using real estate for tax shelter.

In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. The Tax Reform Act of 1986 had a profound impact upon the real estate industry and as a result the Savings and Loan Industry. The Tax Reform Act of 1986 TRA86 was the culmination of a concerted effort by the Congress and the president to improve the efficiency and per-ceived equity of the federal tax system.

THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986. The changes were so significant that Title 26 of the US. The act either altered or eliminated many deductions changed the tax rates and eliminated several special calculations that had been permitted on the basis of marriage or fluctuating income.

Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate industry. This was the first time in US. October 1986 President Reagan signs the Tax Reform Act of 1986.

Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored. This means that investors who purchased shares in limited partnerships or similar investments can no longer use these paper losses from depreciation as a shelter against other income. 1986 Tax Reform Act Was a major legislative change toward reducing tax shelter benefits and thereby restoring greater equity to the Federal tax code.

The Tax Reform Act of 1986 100 Stat. Its important to be smart about your expenses and ensure that you are taking advantage to as many deductions as possible. When investors buy and sell properties or have rental income much of this is considered taxable income.

Real Estate and The Tax Reform Act of 1986 Patric 1-i. Real estate investing is a great way to make a lot of money.

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Michigan Legislature State Of Michigan

What Are Municipal Bonds And How Are They Used Tax Policy Center

Anatomy Of A Domestic Tax Shelter

The Constitutionality Of Retroactive Tax Legislation Castro Co

How Is A Tax Shelter Calculated In Real Estate

Reagans 1986 Tax Reform Act Lowered Taxes Simplified Reporting

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

How Is A Tax Shelter Calculated In Real Estate

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

_edited.jpg)

Wandering Tax Pro Remembers The Tax Reform Act Of 1986

Depreciation And The Taxation Of Real Estate Everycrsreport Com